KR Webzine Vol.164

KR Webzine Vol.164

- Dec. 2021

- Nov. 2021

- Oct. 2021

- Sep. 2021

- Aug. 2021

- Jul. 2021

- Jun. 2021

- May. 2021

- Apr. 2021

- Mar. 2021

- Feb. 2021

- Jan. 2021

- Dec. 2020

- Nov. 2020

- Oct. 2020

- Sep. 2020

- Aug. 2020

- Jul. 2020

- Jun. 2020

- May. 2020

- Apr. 2020

- Mar. 2020

- Feb. 2020

- Jan. 2020

- Dec. 2019

- Nov. 2019

- Oct. 2019

- Sep. 2019

- Aug. 2019

- Jul. 2019

- Jun. 2019

- May. 2019

- Apr. 2019

- Mar. 2019

- Feb. 2019

- Jan. 2019

- Dec. 2018

- Nov. 2018

- Oct. 2018

- Sep. 2018

- Aug. 2018

- Jul. 2018

- Jun. 2018

- May. 2018

- Apr. 2018

- Mar. 2018

- Feb. 2018

- Jan. 2018

- Dec. 2017

- Nov. 2017

- Oct. 2017

- Sep. 2017

- Aug. 2017

- Jul. 2017

- Jun. 2017

- May. 2017

- Apr. 2017

- Mar. 2017

- Feb. 2017

- Jan. 2017

- Dec. 2016

- Nov. 2016

- Oct. 2016

- Sep. 2016

- Aug. 2016

- Jul. 2016

- Jun. 2016

- May. 2016

- Apr. 2016

- Mar. 2016

- Feb. 2016

- Jan. 2016

- Dec. 2015

- Nov. 2015

- Oct. 2015

- Sep. 2015

- Aug. 2015

- Jul. 2015

- Jun. 2015

- May. 2015

- Apr. 2015

- Mar. 2015

- Feb. 2015

- Jan. 2015

- Dec. 2014

- Nov. 2014

- Oct. 2014

- Sep. 2014

- Aug. 2014

- Jul. 2014

- Jun. 2014

- May. 2014

- Apr. 2014

- Mar. 2014

- Feb. 2014

- Jan. 2014

- Dec. 2013

- Nov. 2013

- Oct. 2013

- Sep. 2013

- Aug. 2013

- Jul. 2013

- Jun. 2013

- May. 2013

- Apr. 2013

- Mar. 2013

- Jan. 2013

- Dec. 2012

- Nov. 2012

- Oct. 2012

- Sep. 2012

- Aug. 2012

- Jul. 2012

- Jun. 2012

- May. 2012

- Apr. 2012

- Mar. 2012

- Feb. 2012

- Jan. 2012

- Dec. 2011

- Nov. 2011

- Oct. 2011

- Sep. 2011

- Aug. 2011

- Jul. 2011

- Jun. 2011

- May. 2011

- Apr. 2011

- Mar. 2011

- Feb. 2011

- Jan. 2011

- Dec. 2010

- Nov. 2010

- Oct. 2010

- Sep. 2010

- Aug. 2010

- Jul. 2010

- Jun. 2010

- May. 2010

- Apr. 2010

- Mar. 2010

- Feb. 2010

- Jan. 2010

- Dec. 2009

- Nov. 2009

- Oct. 2009

- Sep. 2009

- Aug. 2009

- Jul. 2009

- Jun. 2009

- May. 2009

- Apr. 2009

- Mar. 2009

- Feb. 2009

- Jan. 2009

- Dec. 2008

- Nov. 2008

- Oct. 2008

- Sep. 2008

- Aug. 2008

- Jul. 2008

- Jun. 2008

- May. 2008

- Apr. 2008

- Mar. 2008

- Feb. 2008

10

October 2021

- HIGHLIGHTS

- R&D ISSUES

-

TECHNICAL INFORMATION

- Pt.1 Classification and Surveys / Pt.3 Hull Structures / Pt.4 Hull Equipment / Guidance for the Prevention System of Pollution from Ships / Guidance for Approval of Service Suppliers / Guidance for Approval of Manufacturing Process and Type Approval, Etc.

- Notice for Amendments to the KR Technical Rules - Part 6 of the Rules/Guidance, Guidance for Prevention System of Pollution from Ships

- CCC 7 - News Flash

- KR uploads video (Shipboard Fire Fighting Drill rev.1)

- NOTICE BOARD

1. The expansion of the wind market

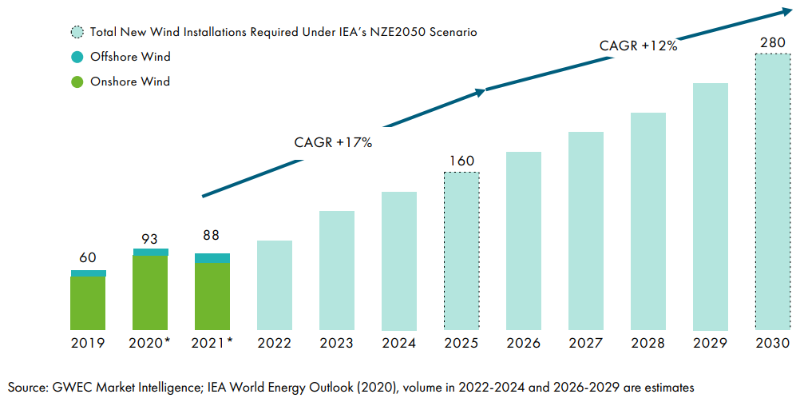

Demand for renewable energy has been dampened by falling global oil prices, but investment is growing in the renewable energy sector to cope with the mandatory reduction in greenhouse gases such as carbon neutrality across the world. As of last year, the number of newly installed wind turbine facilities worldwide numbered about 93 GW, which is about 300 trillion won in market size.

However, as of 2020, the cumulative installation of domestic wind turbine facilities was only 1.6 GW but taking into account the government's renewable energy expansion policy "Renewable Energy 3020" and the amount of wind turbine facilities allocated thereto, it is expected to grow into a market worth about 100 trillion won.

<Predicting the installation capacity and growth rate of new wind turbines around the world>

<Predicting the installation capacity and growth rate of new wind turbines around the world>

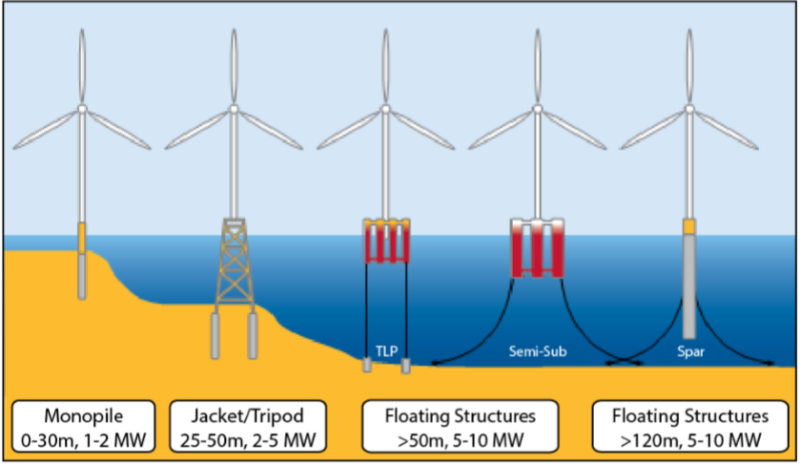

2. The emergence of floating offshore wind turbines

Currently, fixed wind turbines with a depth of less than 60m are standard in the offshore wind market, but the demand for turbines suitable for a deep water depth of 60m~150m is expected to increase in the near future. The floating offshore wind turbine system has the advantage of not being fixed to the sea floor, floating on the sea using its own buoyancy, allows for better wind resources than onshore or fixed offshore wind turbines, and limits noise and other complaints.

<The concept of offshore wind turbines depending on the depth of the water>

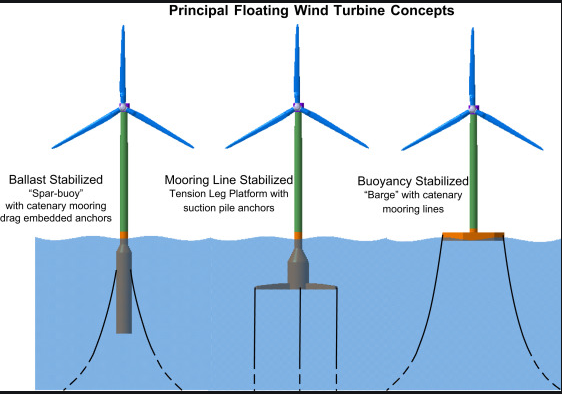

There are various floating offshore wind turbine systems, but if classified in the most common form, they are divided into Semi-Submersible, Spar Bouy, and Tension Leg Platform (TLP) according to the system stability maintenance method and installation depth. The cylindrical offshore wind turbine system ensures stability by deeply applying the drift to maintain stability during offshore operations. It is a model suitable for regions with relatively deep water. In the case of the TLP type, it is installed using the tension of a string for mooring, and since a large tension is required for stable installation, it is suitable for installation in areas where the ground is relatively hard. Finally, the semi-submersible type uses the buoyancy and mooring system of the floating body and is generally suitable for a depth of 50m to 150m.

<Types of floating wind turbine systems>

The type selection of these substructures is determined by a combination of environmental conditions (ground, depth, wind speed, etc.) of the area for installation and the environment (rock depth, dock size, etc.) of the shipyard producing the substructure, but the installation and transportation of floating turbines can be a major factor too.

3. Floating offshore wind market outlook

Of the cumulative installation facilities for wind turbines around the world, offshore wind turbine facilities contribute 23 GW, and most are still concentrated in fixed offshore wind turbine systems. However, compared to onshore wind turbine growth which is slow, the installation trend for offshore wind turbines is increasing more than 16% every year as shown in the following figure. Offshore wind turbines, including those in Britain and Germany, are driving the growth of shipbuilding and marine technology and related industrial infrastructure power houses, but China, which has the world's largest wind market, is also significant. Compared to onshore wind turbines, which face limitations of growth, marine wind turbines are expected to continue to grow for a while, and Korea is preparing for this.

<Predicting the growth rate of the offshore wind market>

Meanwhile, Bloomberg predicted that the cumulative installation capacity of floating offshore wind turbine will reach 237 MW by 2022, indicating that floating offshore wind turbine, an empirical stage, has entered the introduction of commercialization. In addition, if floating offshore wind turbine facilities are mass-produced through economies of scale in the mid to long term, related costs are expected to decrease, opening another wind turbine and shipbuilding marine market called floating offshore wind industry.

Various preparations such as the development of related technologies are required to preemptively respond to the floating offshore wind market in the future, while certification systems such as evaluation and test technologies are also required to ensure the safety of floating wind systems. To this end, it is necessary to additionally review the contents of classification registration along with the currently operating wind turbine certification system, and if necessary, the production and operation of more stable and safe floating offshore wind turbines should be guaranteed through the introduction of additional certification schemes.

< Floating Offshore Wind Market Forecast >

4. Floating offshore wind turbine

standards and certification systems

In the case of wind turbines installed in Korea, KS certification is conducted through the New and Renewable Energy Center, an institution affiliated with the Korea Energy Corporation, to obtain Renewable Energy Certifications (RECs). The wind turbine performs design evaluation, test evaluation, and manufacturing evaluation through KS certification, respectively, and through this process, evaluation of the stable design and operation of the wind turbine is carried out. Regarding the details of KS certification, it is carried out based on the "Medium and Large Wind Turbine KS Certification Business Regulations (2015.7.30)", and the cited standards are as follows.

1. KS Q ISO/IEC 17065 Conformity Evaluation - Requirements for product,

process and service certification bodies

2. KS C IEC 61400-22 Wind Turbine Plant - Part 22: Conformity Test and Certification

3. KS Q 8003 KS Certification System - Requirements for certification of new and renewable

energy facilities.

4. K SC 8572 Design Requirements for Medium and Large Wind Turbine for onshore (July 2015)

5. K SC 8573 Design Requirements for Medium and Large Wind Turbine for offshore (July 2015)

Meanwhile, in the case of floating offshore wind turbine, the enactment of the "IEC61400-3-2 Design Requirements for floating offshore wind turbine," which is the basis for meeting KS standards, was delayed and completed in April 2019, and there is currently no related KS C. Fortunately, the Korea Energy Corporation is working to meet KS standards related to floating offshore wind turbine, and the final version is expected to be published soon. Once the standard is established, KS certification is expected to be equipped with a certification system for floating wind turbines, which will expand the current safety evaluation and testing of floating and offshore wind turbines to ensure stable operation of the system.

5. Register classification of floating offshore wind turbine

In addition, floating wind turbine may be included in the category of marine structures, unlike conventional fixed turbines. Therefore, the application of various safety-related regulations generally applied in the oil & gas industry should also be considered. Portugal, Spain, and Britain dominated the world through maritime trade during the 15th century, but more than one in ten ships sank due to frequent maritime accidents. As a result, a private technology organization that evaluates the safety of ships, that is, a ship class, was established at the request of the insurance industry, and 97% of ships and marine structures are currently registered in the ship class for regular inspections. In 1914, the international community enacted the International Convention for the Safety of Life at Sea (SOLAS) due to the worst-ever accident, which is based on the classification guideline.

< Connecting wind energy in the ocean >

Therefore, in addition to KS certification that will be applied soon, floating offshore wind turbine will also need to be guaranteed safety such as regular inspection and supervision of floating wind systems through advance registration. However, in the case of the "Vessel Safety Act," which is the basis for the current advancement, the relevant items are listed in Article 2 Subparagraph 1 for floating offshore structures, but it is true that there is no consideration for floating offshore wind turbine that is not common in Korea. According to a press release by Ulsan City Hall, about 6GW of floating offshore wind turbine is being installed. Considering the installation area of floating turbines that usually require a radius of 1 to 2 km per unit, it is expected to occupy a considerable area of sea space, and the revision of related laws should prioritize the entry of floating offshore wind systems.

6. Conclusion

The global wind turbine generation market has been increasing rapidly since 2005, and although there have been several fluctuations, it has recorded a high growth rate of more than 10% on average every year. In the United States, Europe, and China, the capacity of unit devices has steadily increased since it exceeded the MW unit in early 2000, and as of 2019, large wind turbines with 5 MW on onshore and more on sea are being installed. In addition, in the onshore turbine market, where problems such as saturation of installable areas, various civil complaints, and transportation of large turbines are occurring, market changes to marine wind turbine that is relatively free from these problems are continuing. This trend is expected to accelerate further and finally result in floating offshore wind turbine capable of installing long-distance and large-capacity turbines.

Currently, the fixed onshore wind turbine generation market is in the form of a red ocean dominated by advanced companies in China, the United States, and Europe. Therefore, in the case of Korea, a latecomer, a leading response is needed to the new wind market to be developed in the future through the preemptive development of floating offshore wind technology, a new market. If the original technology of floating wind turbine generation systems is secured based on advanced shipbuilding and offshore plant technologies in Korea, it will be able to create new national growth engines along with leading the global offshore plant market. Through this, it will be possible to achieve three birds with one stone result in energy production, fostering future export businesses, and creating jobs, contributing to the development of the national industry in the future and strengthening its competitiveness as an energy exporter.

In addition, considering the characteristics of floating offshore wind turbines installed and operated on a large scale for economies of scale, safety of turbine complexes along with individual turbine systems should be prioritized above all else. To this end, it is necessary to focus on the stable development and operation of floating wind turbines through the introduction of additional certification schemes such as classification register along with existing well-equipped certification systems such as KS certification. Through this, it is expected that the technology's preoccupation and operational stability in the floating offshore wind market will be guaranteed in the future, and that it will be closer to the global market preoccupation of related technologies in the future.