KR Webzine Vol.157

KR Webzine Vol.157

- Dec. 2021

- Nov. 2021

- Oct. 2021

- Sep. 2021

- Aug. 2021

- Jul. 2021

- Jun. 2021

- May. 2021

- Apr. 2021

- Mar. 2021

- Feb. 2021

- Jan. 2021

- Dec. 2020

- Nov. 2020

- Oct. 2020

- Sep. 2020

- Aug. 2020

- Jul. 2020

- Jun. 2020

- May. 2020

- Apr. 2020

- Mar. 2020

- Feb. 2020

- Jan. 2020

- Dec. 2019

- Nov. 2019

- Oct. 2019

- Sep. 2019

- Aug. 2019

- Jul. 2019

- Jun. 2019

- May. 2019

- Apr. 2019

- Mar. 2019

- Feb. 2019

- Jan. 2019

- Dec. 2018

- Nov. 2018

- Oct. 2018

- Sep. 2018

- Aug. 2018

- Jul. 2018

- Jun. 2018

- May. 2018

- Apr. 2018

- Mar. 2018

- Feb. 2018

- Jan. 2018

- Dec. 2017

- Nov. 2017

- Oct. 2017

- Sep. 2017

- Aug. 2017

- Jul. 2017

- Jun. 2017

- May. 2017

- Apr. 2017

- Mar. 2017

- Feb. 2017

- Jan. 2017

- Dec. 2016

- Nov. 2016

- Oct. 2016

- Sep. 2016

- Aug. 2016

- Jul. 2016

- Jun. 2016

- May. 2016

- Apr. 2016

- Mar. 2016

- Feb. 2016

- Jan. 2016

- Dec. 2015

- Nov. 2015

- Oct. 2015

- Sep. 2015

- Aug. 2015

- Jul. 2015

- Jun. 2015

- May. 2015

- Apr. 2015

- Mar. 2015

- Feb. 2015

- Jan. 2015

- Dec. 2014

- Nov. 2014

- Oct. 2014

- Sep. 2014

- Aug. 2014

- Jul. 2014

- Jun. 2014

- May. 2014

- Apr. 2014

- Mar. 2014

- Feb. 2014

- Jan. 2014

- Dec. 2013

- Nov. 2013

- Oct. 2013

- Sep. 2013

- Aug. 2013

- Jul. 2013

- Jun. 2013

- May. 2013

- Apr. 2013

- Mar. 2013

- Jan. 2013

- Dec. 2012

- Nov. 2012

- Oct. 2012

- Sep. 2012

- Aug. 2012

- Jul. 2012

- Jun. 2012

- May. 2012

- Apr. 2012

- Mar. 2012

- Feb. 2012

- Jan. 2012

- Dec. 2011

- Nov. 2011

- Oct. 2011

- Sep. 2011

- Aug. 2011

- Jul. 2011

- Jun. 2011

- May. 2011

- Apr. 2011

- Mar. 2011

- Feb. 2011

- Jan. 2011

- Dec. 2010

- Nov. 2010

- Oct. 2010

- Sep. 2010

- Aug. 2010

- Jul. 2010

- Jun. 2010

- May. 2010

- Apr. 2010

- Mar. 2010

- Feb. 2010

- Jan. 2010

- Dec. 2009

- Nov. 2009

- Oct. 2009

- Sep. 2009

- Aug. 2009

- Jul. 2009

- Jun. 2009

- May. 2009

- Apr. 2009

- Mar. 2009

- Feb. 2009

- Jan. 2009

- Dec. 2008

- Nov. 2008

- Oct. 2008

- Sep. 2008

- Aug. 2008

- Jul. 2008

- Jun. 2008

- May. 2008

- Apr. 2008

- Mar. 2008

- Feb. 2008

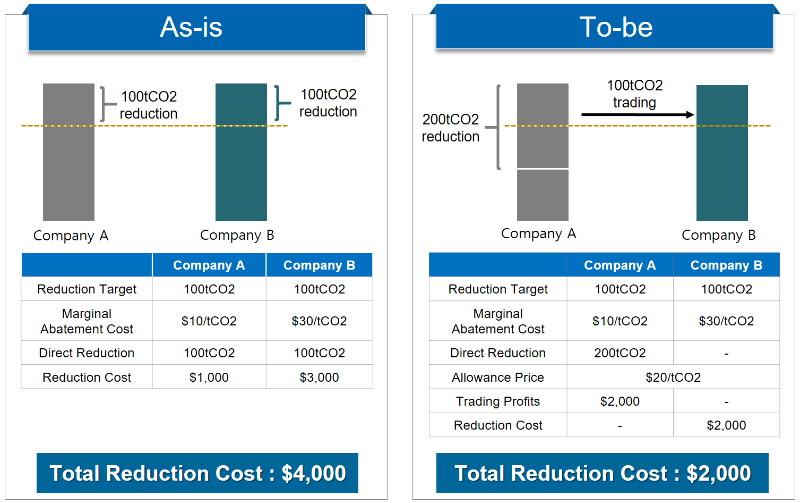

Emission Trading System (ETS) is the market-based measures to control emissions by providing economic incentives for reducing the emissions. In ETS, the company is allocated the emission allowances and has to do the business activities within emission allowances. The company that reduce its emissions could sell its emission allowances to other company and the company that emits emissions in excess of its emission allowances could buy emission allowances from other company. For instance, there are company A and company B required reduction of 100tCO2 respectively and the marginal abatement cost is 10$/tCO2 for company A and 30$/tCO2 for company B. Without ETS, total reduction costs are 4,000$ from 1,000$ of company A and 3,000$ of company B because all companies need to directly reduce their emissions. Under ETS, if the market price of emission allowances is $20/tCO2, total reduction costs are 2,000$ from 0$ of company A that has lower marginal abatement cost than the market price of emission allowances and reduce more emissions than its reduction target, and from 3,000$ of company B that has higher marginal abatement cost than the market price of emission allowances and meet its reduction target by purchasing emission allowances from other companies. Therefore, same emission reductions could be cost-effectively achieved under ETS.

< Reduction costs without and under the emission trading system >

The European Parliament has approved draft legislation to include emissions from ships calling in EU ETS from 1 January 2022. The proposed legislation which includes amendments to the EU Monitoring, Reporting and Verification (MRV) and the ETS Directive is now awaiting approval from the EU Council, and could be adopted in 2021 without different opinions in the public consultation phase and EU Council.

Shipping EU ETS based on proposed amendments to the ETS Directive is as following:

Application: Greenhouse emissions from ships arriving at, within, or departing from ports under the jurisdiction of a Member State covered by Regulation (EU) 2015/757

· Enforcement: From 1 January 2022

· Allocation of allowances: Full auctioning

As International shipping is similar industrial sector to international aviation, the requirements of EU ETS will be also applied at a similar level. International aviation has been included in the EU ETS since 2012. Current requirements of EU ETS for international aviation are applied with the scope to intra-EU flight, 5% of reduction target and 15% auctioning level for allocation of allowances.

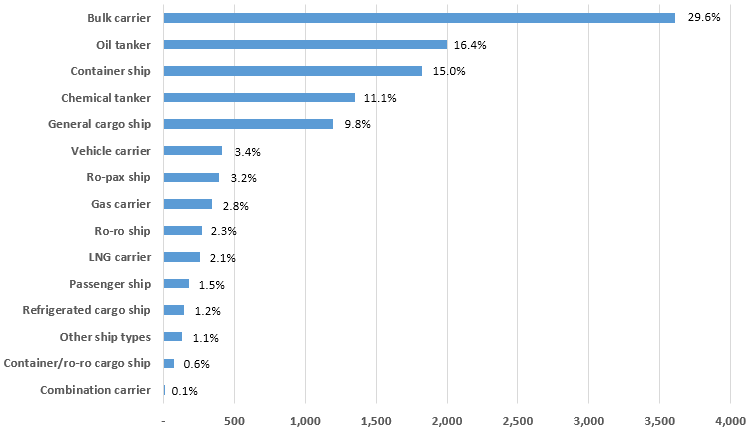

The number of ships applied by Shipping EU ETS is 12,195 on basis of 2019 EU MRV database. The dominant ship types are bulk carrier (29.6%), oil tanker (16.4%), container ship (15.0%), chemical tanker (9.8%) and general cargo ship (9.8%). Total CO2 emissions are 145 million tonnes that are distributed by the emissions from the voyages between EU 47 million tonnes (32.5%), departed from EU 46 million tonnes (31.9%), arrived to EU 42 million tonnes (28.8%) and within EU ports at berth 1 million tonnes (6.7%).

< Number of ships by ship types on basis of 2019 EU MRV >

< CO2 emissions by voyage types on basis of 2019 EU MRV >

KR analyzed the potential impacts of Shipping EU ETS by dividing its criterion into the requirements by ETS Directive amendments and the requirements for international aviation sector.

· Application: Greenhouse emissions from all EU operating voyage (arriving at, within, or

departing from EU ports) and those from only within EU operating voyage

· Allocation of allowances: 100 auctioning and 15% auctioning

· Reduction target: 5%

· Excess emissions: Baseline emissions – emission allowances

· Allowances prices: 45.1 USD per tonnes of CO2 (Feb 22, 2021 – EUA Futures and Currency)

Based on the assumptions and methodology mentioned above, the total costs of ships that operate in EU were estimated as following. The total costs were calculated by auctioning costs plus purchasing costs of allowances for excess emissions. The total costs of Shipping EU ETS could be increased in consideration of the limitation of emission reductions potential for ships and the expected increases of transport demand.

|

Regulated

Voyages |

Baseline Emissions (tCO2) |

Emission Allowances (tCO2) |

Auctioning Level |

Auctioning Costs (million USD) |

Costs for Excess Emissions (million USD)

|

Total Costs (million USD)

|

|

All EU voyages |

145,435,939 |

138,164,142 |

15% |

935 |

328 |

1,263 |

|

100% |

6,231 |

6,559 |

||||

|

Only within EU voyages |

57,043,676 |

54,191,492 |

15% |

367 |

129 |

496 |

|

100% |

2,444 |

2,573 |

< Estimated Costs of Shipping Sectors in accordance with Shipping EU ETS >

The GHG emissions from ships could be reduced by operational measures including slow-steaming and technical measures including energy saving devices (ESD). As Shipping EU ETS will provide additional benefits from environmental cost savings with existing fuel saving benefits, the economic feasibility for those operational and technical measures could be improved.

Meanwhile, it is believed that shipping company may seek the emission reduction though the operation management measures of ships before considering direct reduction measures under the Shipping EU ETS. EU MRV regulation defines that voyage is any movement of a ship that originates from or terminates in a port of call and that serves the purpose of transporting passengers or cargo for commercial purpose and EU MRV voyage is when one of the two ports of call is in the EU. The voyage required by Shipping EU ETS will be same with EU MRV voyage. Therefore, the emissions from Shipping EU ETS voyage could be reduced by adjusting operation routes of the ships through the emission characteristic by each voyage. If Shipping EU ETS regulates all EU voyages, the closer the non-EU arriving port is to the departure EU port, the more emissions reduction could be achieved. In addition, setting the priorities of the ship to apply reduction measures by comparing the emissions of applicable fleet under Shipping EU ETS will be helpful. Because it will be more effective to apply reduction measures to the ship that has more emissions.

Shipping EU ETS will require the addition of environmental response capabilities to the elements that keep competitive of shipping companies. In addition to reducing the emissions from ships, the financial strategies for dealing with environmental costs incurred should be also considered.

The de-carbonization of shipping sector is now new paradigm and the global demand for transition to ESG (Environment, Social, and Governance) management is accelerating. In addition, the strengthened requirements are being introduced to prevent Green Washing, which is a fake eco-friendly business activity. Therefore, it is required to strengthen the response capabilities of the industry and change the direction of business management in maritime industry. KR will provide the sustainable support to achieve de-carbonization in the maritime industry by providing professional solutions and customized services.